- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

I. First-time application for export by account-opening export unitsA complete export agency agreement should be attached with:Verification Form (hereinafter referred to as the "Verification Form")

Unit introduction letter and application;

Original and copy of the business approval document from the foreign trade and economic department;import and exportCopy of the business license and its duplicate;

3. Copy of the business license and its photocopy;

Business entity code certificate and copy;

Copy of customs registration certificate;

Copy of export contract. After verifying the above materials, the foreign exchange bureau will complete the registration procedures for the exporter.

II. Receiving Verification Sheets

Before engaging in export business, the exporting entity shall, with a letter of introduction and the Export Verification Certificate (now replaced by the Seal Card of the Account Opening Entity), collect the verification form from the foreign exchange bureau. When applying for the verification form from the foreign exchange bureau, the exporting entity shall immediately fill in the unit name or affix the unit name stamp in the "Exporter" column of each verification form. The official seal of the unit shall be affixed before the verification form is officially used.

Verification sheets remain valid for customs declaration within two months from the date of receipt. Exporters must return unused verification sheets to the foreign exchange bureau for cancellation within one month after expiration.

The information filled in the verification sheets by exporters must be consistent with the contents recorded on the export customs declaration form.

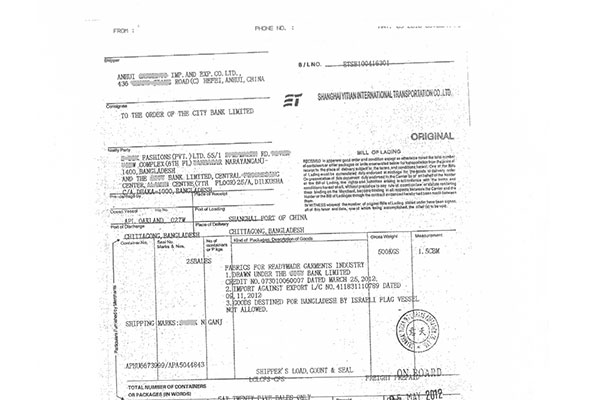

III. Customs Declaration

Exporters shall complete customs declaration procedures with valid verification sheets bearing the companys official seal and relevant documents.

IV. Submitting Counterfoils

Exporting entities shall, within 60 days from the date of customs declaration, present the verification form and the customs documents affixed with anti-counterfeiting labels and stamped with the customs "inspection seal" to...Export ClearanceV. Verificationforeign tradeExporters must complete export foreign exchange verification with the foreign exchange bureau within 30 days of receiving foreign exchange, using verification sheets and the bank-issued special export foreign exchange verification form.

VI. Loss and Reissuance of Verification Sheets

The exporting entity shall, within 30 days from the date of receiving the foreign exchange, complete the export foreign exchange verification with the foreign exchange administration bureau by presenting the verification form and the "Special Export Foreign Exchange Verification Voucher" issued by the bank.

For blank verification sheets, the foreign exchange bureau will cancel them;

For verification sheets already used for customs declaration, verification will be processed based on relevant export documents;

For reissuance of special forms, after completing export verification procedures, exporters must submit a written application to the foreign exchange bureau with the tax authoritys certification of non-tax refund for the corresponding verification sheet. Upon approval, the foreign exchange bureau will issue a reissuance certificate for export foreign exchange verification sheet tax refund copy.

VII. Reissuance of Customs Declaration Forms

If customs declaration forms are lost, exporters must apply for reissuance with customs using the non-verification certificate issued by the foreign exchange bureau.Export DrawbackFor dedicated connections, after completing the export verification procedures, the exporting entity shall, based on the tax authority's issuance of the corresponding export non-tax refund certificate for the verification form, submit a written application to the foreign exchange bureau. Upon approval, the foreign exchange bureau will issue a "Certificate for Reissuance of the Export Collection Verification Form Tax Refund Copy."

In case of refund or compensation under export items, exporters must provide relevant certificates to the foreign exchange bureau, which will verify the authenticity of foreign exchange refund/compensation under the following circumstances:

(1) For goods already exported and verified, the foreign exchange bureau will verify based on:

Export contract;

Refund/compensation agreement and supporting documents;

Export foreign exchange verification sheet (tax refund copy);

Other materials required by the foreign exchange bureau.

2. Refund agreement and relevant supporting documents;

3. Export foreign exchange verification form (refund special copy);

4. Other materials required by the foreign exchange bureau.

(2) For documents already submitted but not yet verified, SAFE shall conduct the review based on the banks exchange memo (or collection notice) and the documents listed in Item 1.FX Settlement Agency(3) For exported goods that have been customs declared but not yet submitted with documents, SAFE shall conduct the review based on Item 1 and the following valid documents:

Customs declaration form for export goods;

Commercial invoice;

Copy of draft;

Banks exchange memo (or collection notice) for settlement.

(4) For export goods not yet customs declared but with full or partial advance payment received, where the contract is terminated and the exporter needs to pay refund compensation in foreign exchange, SAFE shall conduct the review based on the original export contract, contract termination proof, banks exchange memo (or collection notice), and the importers payment notice.

After verifying the above documents provided by the exporter, SAFE shall issue a Proof of Offset Against Export Verification. Banks shall process the foreign exchange refund for the exporter based on this proof.

After verifying the above-mentioned documents provided by the export unit, the foreign exchange bureau issues a "Proof of Offset Against Export Foreign Exchange Verification and Write-off." The bank then processes the foreign exchange refund for the export unit based on this proof.paymentHow to handle export agency foreign exchange verification?

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912